Variable costs are corporate expenses that vary with production and sales. As a company’s production or sales volume rises or falls, variable costs do too.

Variable cost is a Business Term that includes a manufacturer’s raw materials and packaging or a retailer’s credit card transaction fees or shipping costs, which fluctuate with sales. Variable costs differ from fixed costs.

Recognizing Variable Costs

Businesses have variable and fixed costs. Sales and production determine variable costs. Variable production costs are constant per unit. Variable costs rise with production. When production decreases, variable costs decrease.

Sales commissions, direct labor, production materials, and utilities are variable costs.

Variable costs can be adjusted quickly, making them short-term. A company with cash flow issues may immediately change production to avoid these costs.

Variable Cost Calculation Formula

The total variable cost is the output multiplied by the variable cost per unit:

Total Variable Cost = Total Output X Variable Cost Per Unit.

Profits vary by variable cost per unit. It’s usually the sum of the variable costs listed below. If variable costs are incurred in batches (100 pounds of raw materials for 10,000 finished goods), they may need to be allocated across goods.

Cost Variables Types

Variable costs occur during manufacturing. A major athletic apparel manufacturer’s manufacturing and distribution processes illustrate these variable costs.

Raw Materials

Raw materials are purchased goods that become finished products. The athletic brand won’t pay for leather, synthetic mesh, canvas, or other materials if it doesn’t make the shoes. Assuming no major differences in manufacturing, a company should spend about the same on raw materials for each unit produced.

Physical Work

The athletic company will only pay some labor if it produces more. Some salaried positions receive the same pay whether the output is 100,000 or 0. Direct labor earns hourly workers more money.

Commissions

A company receives a percentage of sales as a commission. No sales, no commission. The expense fluctuates with sales activity because commissions depend on the salesperson’s qualification.

Utilities

Energy is used when the manufacturing line starts equipment and production. Utilities are usually turned off when the product is finished. Production typically affects utilities. As a company produces more, it may need more power or energy, increasing variable utility costs.

Shipping/Freight

Only certain actions will incur packaging or shipping costs. Thus, the cost of shipping a finished good depends on its quantity. Shipping costs vary, but an in-house mail distribution network with a personalized weighing and packaging production line is a fixed cost.

Variable cost analysis

Variable costing data can analyze costs, prices, and profits. Why variable cost analysis matters:

Costs affect pricing

To recover manufacturing costs, companies price their goods competitively. Variable cost analysis helps a company understand its product inputs and what revenue per unit it needs to make money.

Budgeting and planning involve variable costs. To increase revenue, a company may double output next year. It must realize that variable costs will rise proportionally. Variable costs may change with growth, contraction, or product expansion strategies.

Variable costs determine break-even

A company’s break-even point is fixed costs divided by contribution margin, revenue minus variable costs. Variable cost analysis can determine how many items a company needs to sell to break even and make a certain amount of money.

Variable costs determine margins and net income

Gross margin, profit margin, and net income calculations often include fixed and variable costs. Variable cost analysis lets a company see how increasing or decreasing output affects profit calculations.

Variable costs affect company expenses. Imagine a company renting equipment. It can pay $1,000 (fixed cost) or $0.05 per item manufactured. Since expense structure determines leverage, this decision will affect the company’s profitability and earning potential.

Average Variable Cost vs. Variable Costs That Vary

Variable cost and average variable cost sound similar but describe different expenses. The average variable cost compares variable costs to production over time, while variable cost describes the variable cost of a single product. Variable average:

Average Variable Cost = Total Variable Costs/Total Output

Price increases and discounts may affect variable costs and average variable costs. Consider the variable cost of a multiyear project. Hourly wages are variable, but an employee was promoted last year. The average variable cost will stay the same, but the current variable cost will rise.

Graphed average variable costs are U-shaped. Thus, average variable costing can help a company determine when to stop production to maximize efficiency temporarily. If its AVC is higher, a company may cancel a plan.

Variable vs. Fixed Costs

Fixed costs are production-independent. A firm must pay its fixed costs regardless of output.

Rent, insurance, salaries, and office supplies are fixed costs. Regardless of product volume, a business must pay rent for its space and specifically running a business will have too much cost. Rent remains unchanged regardless of production. Fixed costs are long-term because they do not change with production.

Semi-variable (semi-fixed or mixed) costs fall between fixed and variable costs. These are variable and fixed costs. After a certain production level, costs become variable. Even if production stops, fixed costs remain.

Since their profits depend more on sales, companies with a high variable cost ratio are less volatile.

Special Conditions

Valid Range

Fixed costs have a relevant range, but variable costs may too. It may cost over time if a certain number of hours are worked and for tangible products going into a good. Consider tier-based wholesale bulk pricing.

For the first 1,000 pounds, raw materials may cost $0.50. Orders over 1,000 pounds of raw material cost $0.48. The variable cost is raw materials ($0.50 or $0.48 per pound).

Level of Leverage

Variable and fixed costs affect operating leverage. Fixed costs increase risk, leverage, and upside potential. Variable costs are safer, less leveraged, and have less upside potential.

A company must decide whether to rent equipment for $1,000 or $0.05 per unit:

If the company produces one unit, the per-unit price is $999.95 better.

Both options break even if the company produces 20,000 units.

If the company produces 1,000,000 units, the fixed price saves $49,000.

If it produces less than 20,000 units, the company risks loss. Above this, the company can benefit indefinitely. Leverage rewards companies that don’t choose variable costs if they can produce enough.

Contribution Margin

Variable costs directly affect the contribution margin, which a company collects after covering variable costs. Every dollar of contribution margin pays fixed costs, then contributes to profit.

Companies calculating their break-even point must include variable costs. Variable costs also determine sale targets for a profit target.

Variable Cost Example

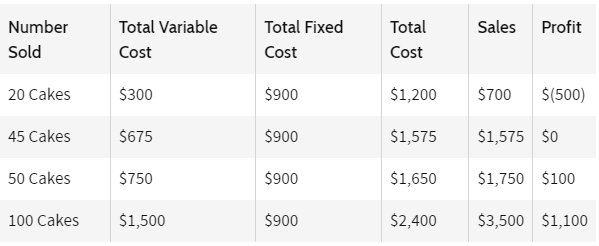

Let’s say a bakery spends $15 to make a cake—$5 for raw materials like sugar, milk, and flour, and $10 for direct labor. The table below shows how variable costs vary with cake quantity.

Variable costs rise with cake production. Variable costs are zero when the bakery does not bake cakes.

Total cost is fixed plus variable. Profits are calculated from total cost:

Profits=Sales−Total Costs

Reducing costs boosts profits. Most businesses cut variable costs rather than fixed ones since lowering rent may require moving to a cheaper location. Cost reduction usually reduces variable costs.

The bakery’s gross profit per cake is $35 minus $15, or $20. Gross profit minus fixed costs equals net profit. If the bakery has $900 in monthly fixed costs, including utilities, rent, and insurance, its monthly profit will be:

Businesses lose when fixed costs exceed gross profits. When selling 20 cakes a month, the bakery makes $400 in gross profits. Sales would drop $500 due to its $900 fixed cost. Fixed costs equal gross margin at break-even, resulting in no profit or loss. The bakery breaks even by selling 45 cakes for $675 variable costs.

Variable costs for raw materials, direct labor, and advertising may need to be reduced to increase profit. However, cutting costs should not lower product or service quality, which would hurt sales. Businesses increase their gross profit margin or contribution margin by lowering variable costs.

Management uses the contribution margin to calculate revenue and profit per product sold. Contribution margin =

Contribution Margin

The bakery contribution margin is 57.14% ($35 – $15) / $35. If the bakery cuts variable costs to $10, its contribution margin will rise to 71.43% ($35 – $10) / $35. The contribution margin increases profits. The bakery would earn $0.71 per dollar in sales if it cut variable costs by $5.

Variable Cost Examples?

Variable costs include COGS, raw materials and production inputs, packaging, wages, commissions, and utilities (such as electricity or gas that increases with production capacity).

Variable vs. fixed costs?

Variable costs vary with production, while fixed costs do not. COGS includes variable costs but not fixed costs. Sales commissions in per-unit production costs can affect variable costs during sales and production fluctuations. Even if production drops significantly, fixed costs must be paid.

Variable costs affect growth and profitability.

Production increases variable costs. Expanding may not make sense if these costs rise faster than new unit profits. The company must determine why it cannot achieve economies of scale. As production scales up, variable costs decrease as a percentage of total cost per unit.

Is Marginal Cost the Same as Variable Cost?

No. Producing one more unit costs marginal cost. Marginal cost includes fixed and variable production costs. However, since fixed costs are static, production scales down their weight.

Total Variable Cost Formula

Variable costs scale with output, so each unit has the same amount. Thus, multiplying output by unit variable cost yields total variable costs.

Bottom Line

Manufacturing costs vary. One cost profile increases only if output increases. Variable costs change with each unit produced, while fixed costs stay the same. This cost structure protects a company from falling demand but limits its profit potential.